Vanguard risk profile

It might seem surprising that your portfolio's risk vanguard risk profile could change even if you didn't change any of your investments. But when one asset class is doing better than the others, your portfolio could become "overweighted" in that asset class, vanguard risk profile. Check your portfolio at least once a year, and if your mix is off by at least 5 percentage points, consider rebalancing.

Your attitude to risk is one of the most important factors to consider when it comes to investing. This is because growth assets, like shares and property securities, tend to have more volatile returns over the shorter term but they do have the potential to produce higher long-term returns. Assets like bonds and cash are considered lower risk and less volatile but they generally do not have the same potential for similar high returns over the long term. Understanding whether you have an appetite for risk and where you are on the risk spectrum is often the first step on an investment journey. Generally, the longer you have to invest, the more growth assets you can include in your portfolio.

Vanguard risk profile

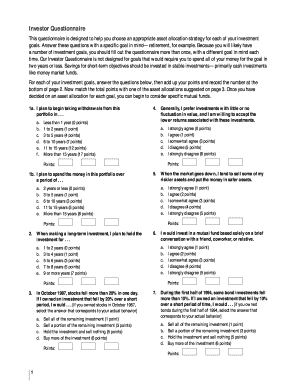

The allocations provided are based on generally accepted investment principles. There's no guarantee, however, that any particular asset allocation or combination of investments will meet your objectives. All investments involve risks, and fluctuations in the financial markets and other factors may cause the value of your account to decline. You should consider all of your options carefully before investing. The investor questionnaire is provided to you free of charge. It doesn't provide comprehensive investment or financial advice. Vanguard isn't responsible for reviewing your financial situation or updating the suggestions contained herein. By selecting Accept , you agree to the terms outlined on this page. If you request additional information, you may be required to consent to electronic delivery again. Vanguard doesn't charge you a fee to use our website, but you could incur expenses from an internet service provider when you access information online. Also, be aware that your internet service provider may occasionally experience system failure, and hyperlinks to documents may not function properly. Our quiz can help you find a path that best fits your needs.

Since then a great many studies, looking at different periods and types of funds, have come to similar conclusions, vanguard risk profile, including a Vanguard study based on monthly returns for UK balanced funds from January through September The global case for strategic asset allocation and an examination of home bias Scott et al.

ETFs are cost-effective tools that can help you diversify a portfolio and execute a range of strategic and tactical options. Every ETF strategy comes with its own purpose and risk profile. Investors should also be realistic about their own temperament and tolerance for risk. Some of the ETF strategies described here entail taking concentrated investment positions, so it's important to weigh the extra risks involved against the potential rewards. Gain fast, precise and cost-effective access to a broad variety of asset and sub-asset classes to build a strategic core portfolio. Fill gaps in a portfolio to broaden diversification, minimise benchmark risk or add exposure to specific market segments or factors. Combine index ETFs and low-cost actively managed funds for diversification and the opportunity for outperformance.

An income portfolio consists primarily of dividend-paying stocks and coupon-yielding bonds. If you're comfortable with minimal risk and have a short- to midrange investment time horizon, this approach may suit your needs. Keep in mind, depending on the account, dividends and returns can be taxable. Average annual return: 5. Average annual return: 6. Average annual return: 7.

Vanguard risk profile

The allocations provided are based on generally accepted investment principles. There's no guarantee, however, that any particular asset allocation or combination of investments will meet your objectives. All investments involve risks, and fluctuations in the financial markets and other factors may cause the value of your account to decline. You should consider all of your options carefully before investing.

F-16i

And so on. Vanguard Diversified Funds: example of investor risk profiles Most fund managers offer diversified funds where the mix of investments, or asset allocations, are aligned with a range of investor profiles and their appetite for risk. A loan made to a corporation or government in exchange for regular interest payments. ETFs' trading flexibility and ease of access make them ideal tools for rebalancing a portfolio back to its strategic asset allocation. The asset manager decided to equitise the cash allocation with a small-cap ETF to help minimise the cash drag. Long Credit Aa Index thereafter. Limitations Caveats on the investor questionnaire's ability to provide financial forecasts The asset allocation we suggest for you depends on your assessment of subjective factors, such as your risk tolerance and financial situation. There's no guarantee, however, that any particular asset allocation or combination of investments will meet your objectives. It's important to carefully review the historical returns of various combinations of stocks, bonds, and short-term reserves over various holding periods to see if you can accept the level of risk in a given investment mix. Trading Learn the basics of ETFs, including their history, how they compare to mutual funds and more.

There's no one-size-fits-all approach to investing.

You can ask a tax advisor if you have questions about your own situation. Points to consider In a diversified portfolio, gains from some investments may help offset losses from others. Remember that asset mix you chose? Investment returns for the asset allocations are based on the following benchmark indexes:. This view holds that actively managed funds make more sense to use in areas of the market that are considered to be inefficient, such as small-cap or emerging market equities. Point to consider Trading costs may offset some of the potential advantages. To avoid this, you could rebalance only within your tax-advantaged accounts. Check your investments against it and rebalance when needed so you don't drift off course. Source: Vanguard. Returns are in sterling, with income reinvested, to 31 December They don't include other assets, such as real estate, personal property, or precious metals.

0 thoughts on “Vanguard risk profile”