Why is apa share price falling

APA shares enjoy defensive characteristics. It provides essential infrastructure that is predominantly contracted and regulated, with further growth driven from existing customer relationships. If decarbonisation goals are met sooner rather than later, hydrogen will likely be key to achieving this outcome, and APA is strategically positioned for transporting hydrogen in its pipelines, why is apa share price falling. Alinta Energy Pilbara primarily stores and supplies energy to the major miners in the Pilbara region of Western Australia and is made up of four main operating assets:.

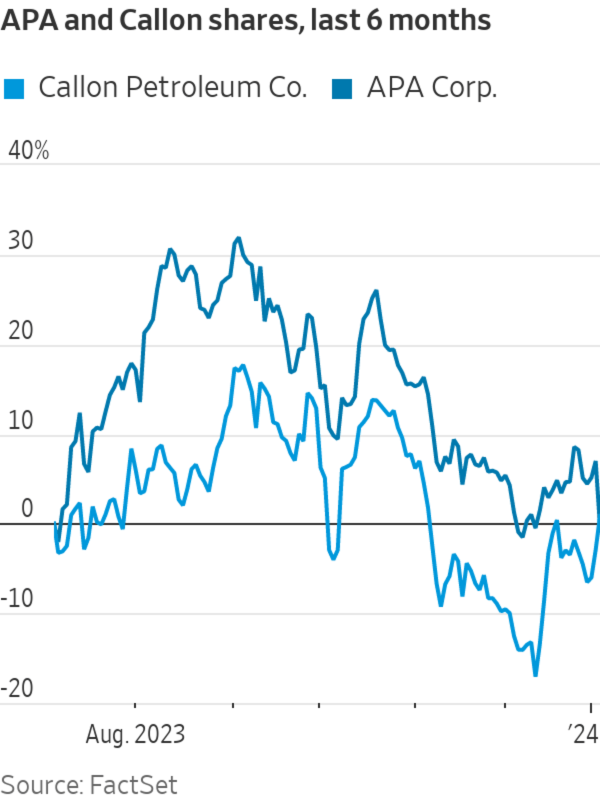

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. That's not much fun for holders. If the past week is anything to go by, investor sentiment for APA Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price. View our latest analysis for APA Group.

Why is apa share price falling

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. APA said that the revenue growth was driven by a "solid" energy infrastructure performance and inflation. The underlying EBITDA didn't grow as quickly because it has been investing in its capabilities to "support growth ambitions and business resilience. The East Coast grid expansion will facilitate increased gas supply to meet projected shortfalls at times of peak demand in southern markets. APA also completed the acquisition of Basslink , which is a large electricity cable that can supply energy in both directions between Tasmania and the mainland. It enables Tasmania to export some of its renewable hydropower. This is an energy infrastructure business that has contracted operational assets across gas and solar power generation, gas transmission, battery energy storage systems BESS and electricity transmission. It also has an extensive development pipeline of projects across those areas. The implied enterprise value multiple is This is expected to add to free cash flow per security in the first full year of ownership, and add value.

Nasdaq 16, February 23, Tony Yoo.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. In afternoon trade, the benchmark index is up 0. Four ASX shares that have failed to follow the market's lead today are listed below. Here's why they are falling:. The APA Group share price is down 2.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. APA said that the revenue growth was driven by a "solid" energy infrastructure performance and inflation. The underlying EBITDA didn't grow as quickly because it has been investing in its capabilities to "support growth ambitions and business resilience. The East Coast grid expansion will facilitate increased gas supply to meet projected shortfalls at times of peak demand in southern markets.

Why is apa share price falling

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. That's not much fun for holders. If the past week is anything to go by, investor sentiment for APA Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Times table 1 100

It includes some of my latest high-conviction ASX stock ideas, research and unique insights. Silver We expect an in-line return from the stock in the next few months. Invest with confidence:. The SPP offer closes at 5pm on 15 September Nonetheless, capital allocation will be easier said than done. The outperformance primarily reflects strong production. But the other, it is not, given it is not just any infrastructure business, it is a gas pipeline owner. The company also operates gas storage and processing facilities, other power stations and even renewable energy facilities. On the bright side, long term shareholders have made money, with a gain of 1.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more.

We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. Open toolbar Accessibility Tools. See all APA announcements. Russell 2, We are confident the energy transition will present attractive opportunities across our four strategic growth asset classes of renewable power generation and firming, gas transmission, electricity transmission and future fuels, and we are well placed to build further momentum over the year ahead. Looking to the industry generally, multiple factors are delaying the transition, including slow planning approvals, NIMBYs community opposition and rising costs not least of which is interest rates but also skilled labour. Bronwyn Allen With interest rates as high as they are and the best savings accounts delivering 5. View All. Nikkei 39, Get Luke's weekly newsletter free stock ideas!

It not meant it

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.