Woodside buy or sell

Woodside is a beneficiary of continued increase in demand for energy. Behind coal, gas has been the fastest-growing primary energy segment globally. Woodside is favorably located on Woodside buy or sell doorstep. The global economy is cooling off and demand for energy will follow suit, particularly if Chinese growth rates taper.

Woodside Energy Group Ltd. Woodside Energy Group Ltd engages in the exploration, evaluation, development, production, and marketing of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe. About the company. The company produces liquefied natural gas, pipeline gas, crude oil and condensate, and natural gas liquids. Trading at Earnings are forecast to grow 4. Dividend of 7.

Woodside buy or sell

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Can the ASX energy share turn things around in ? UBS said recently it was cautious about growing risks to the Scarborough and Pluto 2 schedule and, therefore, the capital expenditure. UBS pointed out the successful appeal at Scarborough a few months ago by a traditional custodian of Woodside's regulatory approval to conduct seismic surveying at Scarborough over the quarter was another example of the "heightened pressure on regulatory approvals for hydrocarbon developments. Greenpeace is the latest organisation to take Woodside to court over alleged greenwashing. In what might be another headwind, investors often value blue-chip companies based on how much profit they're expected to make. If this is the case, it's understandable to see the Woodside share price dropping. Based on the current Woodside share price and the current exchange rate, it's valued at 12x FY24's forecast earnings, according to UBS. Whatever happens next with energy prices could have a significant influence, but that seems very unpredictable. It could also pay a grossed-up dividend yield of 9. That's a prediction, however, and price targets can change.

The company produces liquefied natural gas, pipeline gas, crude oil and condensate, and natural gas liquids.

March 5, Bernd Struben. ASX energy shares have come under selling pressure since oil and gas prices began to retrace in late September. March 4, James Mickleboro. March 3, James Mickleboro. March 3, Bernd Struben. Woodside reduced its final dividend payout, but some investors are still making hay. March 1, Sebastian Bowen.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With the landscape for hydrocarbons players shifting substantially over the coming decade, the horizon for Woodside investors is set to be a colourful one. So, is it a buy in ? Here's what the experts think. It reckons the company "has benefited from being in the right place, at the right time", especially as the pair already has existing relationships. In the opine of Morgans, Woodside is "clearly getting the better of the deal", especially as BHP is willing to accept a discount for the deal. Back in November, Morgan Stanley was pleasantly surprised at the company's Scarborough project's return prospects.

Woodside buy or sell

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. It went up by around 1. But, the key question is, are Woodside shares an opportunity after revealing a very strong period of growth? The ASX oil share benefitted from higher resource prices during the half-year. Woodside pointed to this move as one that increased financial and operational strength, delivered by a larger, geographically diverse portfolio of "high-quality operating assets". BHP's former assets and improved reliability of its LNG liquefied natural gas facilities contributed to this result. The company's management has confidence in the longer-term demand. Safe and reliable supplies of gas are not only critical to global energy security but will play a key role as our customers seek to decarbonise, alongside new energy sources such as hydrogen and ammonia. UBS notes that the company's report was largely what the market expected, with a solid-looking balance sheet thanks to a low level of debt.

Grabbing huge boobs

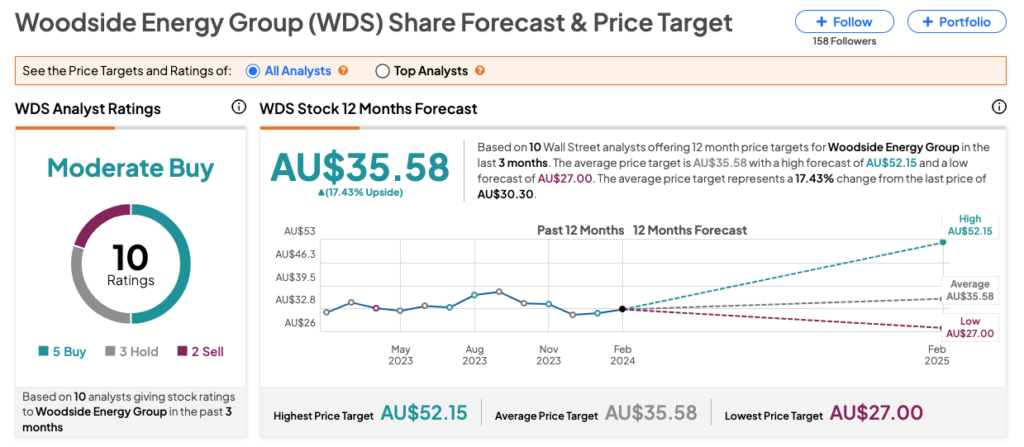

My Watchlist. Based on 11 analysts giving stock ratings to Woodside. When Macroaxis issues a 'buy' or 'sell' recommendation for Woodside Energy Group, the advice is generated through an automated system that utilizes algorithms and statistical models. Jun That's a prediction, however, and price targets can change. February 20, Sebastian Bowen. Return on Assets. Day Change. Free Cash Flow. Nov Largest Energy Companies. Return Density. Research Tools. So, no matter how many positions you have, you cannot eliminate market risk. Total Assets.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

However, what challenging for most investors is doing it at the right time to beat the market. Top Financial Bloggers. February 28, Bernd Struben. This type of risk can be diversified away by owning several different stocks in different industries whose stock prices have shown a small correlation to each other. Net Income. Can I see which stocks the top-ranking analysts are rating? Auto Loan Calculator. ETF themes focus on helping investors to gain exposure to a broad range of assets, diversify, and lower overall costs. Fair Value. Can the ASX energy share turn things around in ? Avoid under-diversification and over-optimization by backtesting your portfolios. Book Value Per Share. Find actively-traded funds from around the world traded on over 30 global exchanges. Time Horizon.

You are not right. I am assured. Write to me in PM, we will communicate.

The matchless answer ;)

This idea is necessary just by the way