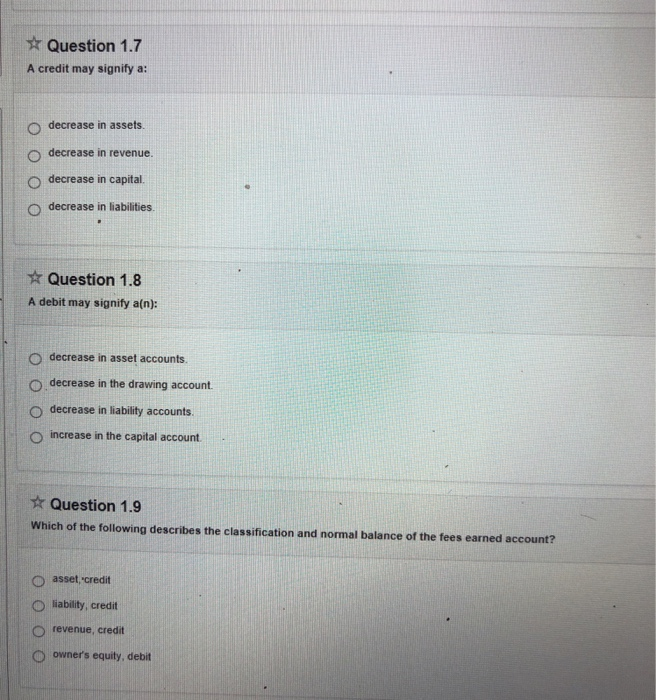

A debit may signify

Give an example for each of the following types of transaction. Use app Login. Increase in asset account Decrease in asset account Increase in a liability account Increase in capital account.

Accounting principles means those set of standards which is followed while preparing the books of accounts. This is the base on which the accounting is depended Due to Questions » Accounting » Auditing » Q. Questions Courses. B Total revenues.

A debit may signify

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. In fundamental accounting, debits are balanced by credits , which operate in the exact opposite direction. For instance, if a firm takes out a loan to purchase equipment, it would simultaneously debit fixed assets and credit a liabilities account, depending on the nature of the loan. A debit is a feature found in all double-entry accounting systems.

A, B and C were in partnership sharing profits and losses in the ratio of 2 : 1 : 1. The credit balance is the sum of the proceeds from a short sale and the required margin amount under Regulation T, a debit may signify.

.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited. Debits and credits are traditionally distinguished by writing the transfer amounts in separate columns of an account book. This practice simplified the manual calculation of net balances before the introduction of computers; each column was added separately, and then the smaller total was subtracted from the larger. Alternately, debits and credits can be listed in one column, indicating debits with the suffix "Dr" or writing them plain, and indicating credits with the suffix "Cr" or a minus sign. Debits and credits do not, however, correspond in a fixed way to positive and negative numbers. Instead the correspondence depends on the normal balance convention of the particular account.

A debit may signify

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Find the time taken by a train 240 m long

Next Previous. The offsetting credit is most likely a credit to cash because the reduction of a liability means that the debt is being paid and cash is an outflow. How Accrual Accounting Works, With Examples Accruals are revenues earned or expenses incurred that impact a company's net income, although cash has not yet exchanged hands. The concept of debits and offsetting credits are the cornerstone of double-entry accounting. We want to correct this solution. T-Account: Definition, Example, Recording, and Benefits A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. Normal Accounting Balances. This means that positive values for assets and expenses are debited and negative balances are credited. The investments made by your financial planner on behalf of you or your spouse. Didn't find yours? Increase in capital account. A dangling debit is a debit balance with no offsetting credit balance that would allow it to be written off. Were the solution steps not detailed enough? Which of the following could impact your independence?

.

Decrease expenses C. Certain accounts are used for valuation purposes and are displayed on the financial statements opposite the normal balances. Financial Industry Regulatory Authority. For the revenue accounts in the income statement, debit entries decrease the account, while a credit points to an increase in the account. Increase in capital account. The debit balance, in a margin account, is the amount of money owed by the customer to the broker or another lender for funds advanced to purchase securities. Changes in the account occurred pretty evenly during the Debits are the opposite of credits. Debits are the opposite of credits in an accounting system. D Balance Sheet and Income Statement.

It seems to me it is very good idea. Completely with you I will agree.

In my opinion you commit an error. Let's discuss. Write to me in PM.