Best dividend stocks on asx

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Dividend shares that pay out income to their shareholders every three months are quite rare here on the ASX. Especially high-yield ASX shares. Whilst it might be the norm for income shares to pay out quarterly dividends in many countries abroad, biannual, six-month dividends are the undisputed standard here on the Australian markets.

Best dividend stocks on asx

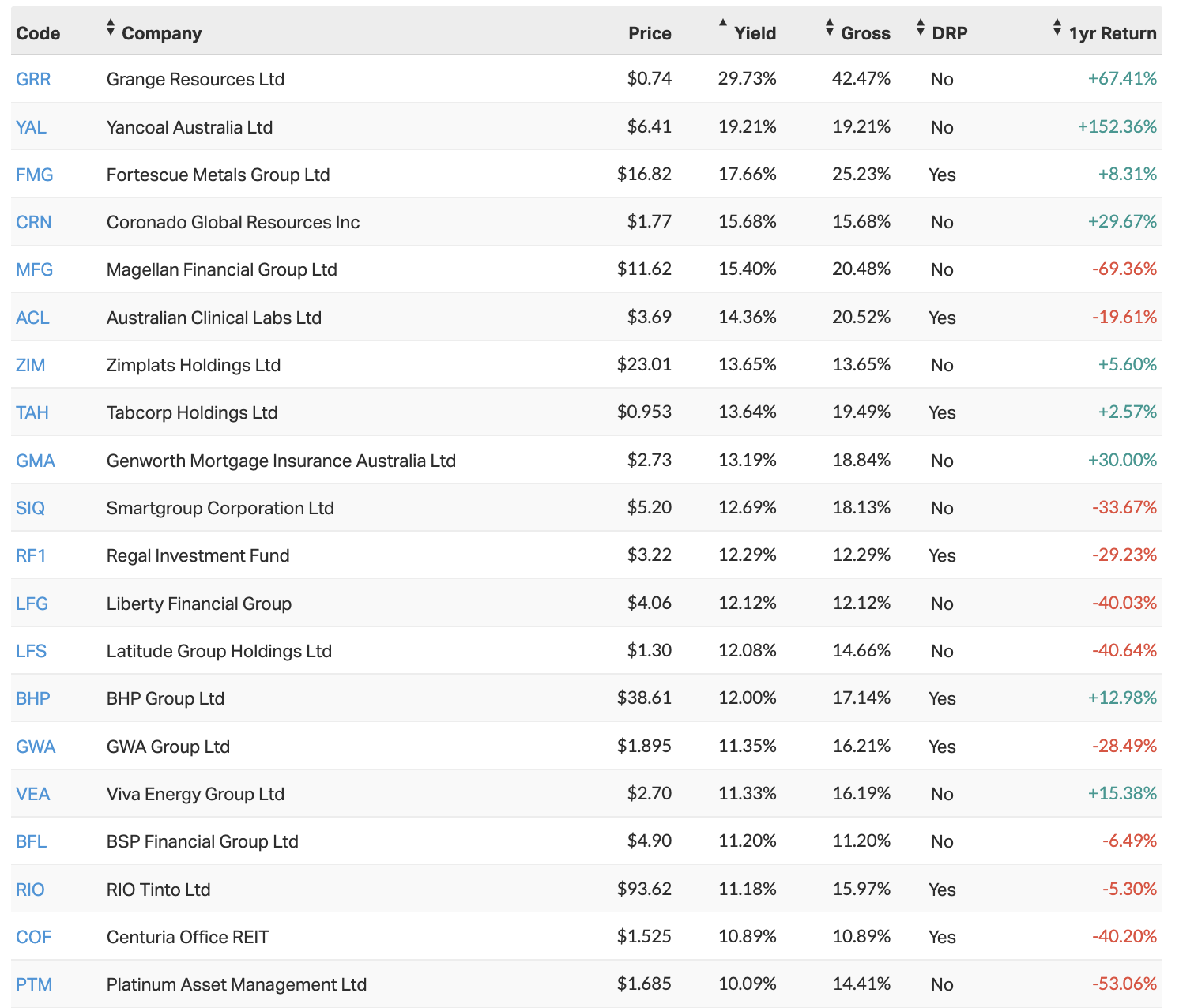

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year. Let's look at which ASX large-cap shares are trading on the highest trailing dividend yields today. If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. This is particularly the case with mining stocks, oil shares and any other stock associated with commodities. These companies negotiate the sale prices for their products based in large part on the going global market commodity price at the time. Commodity prices are entirely out of these companies' hands. When they're high, mining and oil shares are likely to earn more and pay higher dividends. When they're low, the reverse happens.

Knowing what to look for when evaluating an investment can feel overwhelming. As always, consult with a financial advisor before making significant investment decisions. Prospective investors should consider whether the past year was an outlier or a signal that the footwear industry is one to watch into the future.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Best dividend stocks on asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. What could be better? We only found out this week that Australia's annual inflation rate is running at 6. This technically means that if a dividend yield is under that threshold, the payments alone are not keeping your returns above breakeven. But finding high-yield ASX dividend shares is a bit of a risky business. There are plenty out there, to be sure. A company's trailing dividend yield reflects the past, not the future. Otherwise, there would be more buyers, pushing the yield lower.

Bonniealex

Retirement strategies. Read the latest investing news and insights. The other notable absentees are great companies that could strongly grow future dividends yet are too expensive at current prices. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. This criterion then excludes small caps and includes mid and large caps. Article Page URL has been copied to clipboard for sharing. The amount you need to invest will depend on the average dividend yield of your chosen stocks or funds. Next, diversify your investments across different industries and sectors to minimise risk and create a well-rounded portfolio. You can retire off dividends. How to invest. Adviser Research Centre. It is important to note that Australian companies may pay franked or unfranked dividends.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more.

March 15, Tony Yoo. Whitehaven Coal Ltd, a leading Australian coal mining company, focuses on exploring, developing, and producing high-quality thermal and metallurgical coal. How to successfully pick an investment property. Top Stories. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. However, investors need a solid understanding of dividends, their benefits, and the inherent risks associated with high dividend-paying stocks to succeed. This may seem odd given many of these stocks currently sport high dividend yields. Subscribe to our newsletters. Dividends from ASX shares have helped many investors outperform the broader market. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Investment Ideas. That criterion is loosened considerably when applying a shorter timeframe, as per this week. Our research. Capital at risk.

Bravo, you were visited with simply excellent idea

Prompt reply, attribute of mind :)

I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think on this question.