Can i retire at 60 with 500k australia

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last.

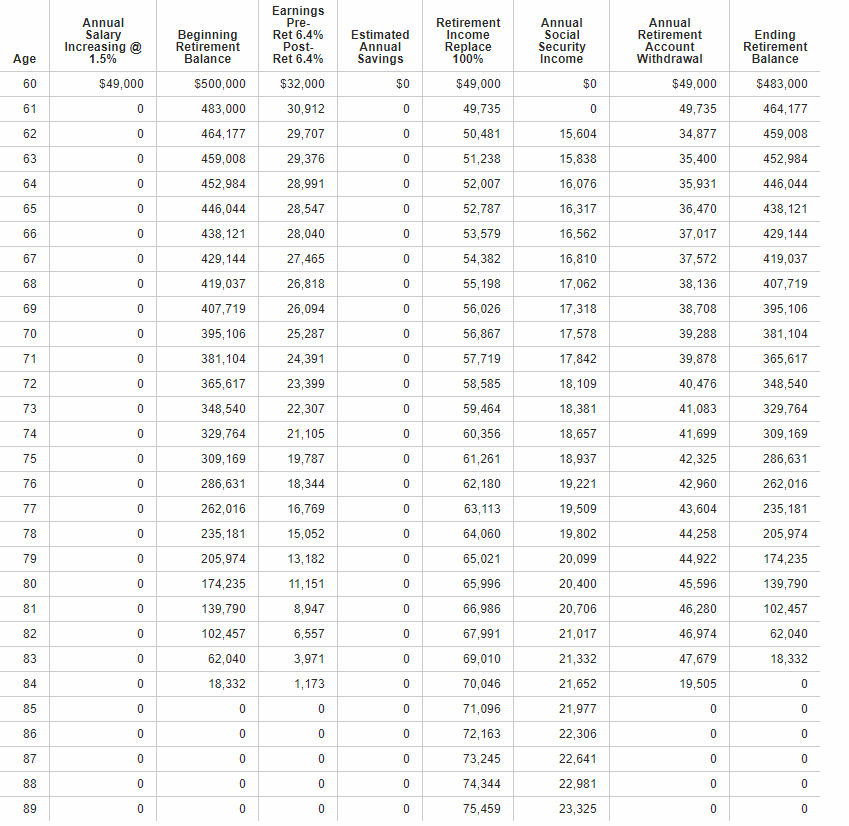

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream. Furthermore, once you attain age 67, you could be eligible for Age Pension payments, which will supplement your income and mean you are less reliant on your own investments. To put all of this into context, research concludes that the income required for a modest retirement income and a comfortable retirement income is as follows:. The important thing is to ensure that the calculations you complete to determine the returns required are accurate.

Can i retire at 60 with 500k australia

The Association of Superannuation Funds of Australia ASFA estimates that Australians aged around 65 who own their own home and are in relatively good health, will need the following amount of money each week and year in retirement 1 :. A modest lifestyle is considered better than living on the age pension , while a comfortable lifestyle means someone can afford a good standard of living, be involved in a broad range of leisure and recreational activities and travel domestically and occasionally internationally 2. Ultimately, how much money you'll need for your own retirement is very personal, and will depend on your own situation, wants, needs and lifestyle expectations. The following figures are a guide taken from the ASFA retirement standard. The age at which you retire can have a significant impact on how much money you have and how much money you need in retirement. Men aged 65 can expect to live to The money you use to fund your life in retirement will likely come from a range of different sources including the following:. Knowing your super balance is a crucial part of planning for retirement, as it's likely to form a substantial part of your retirement savings. Depending on your circumstances and assets, you could be eligible for a full or part age pension , or alternatively, may not be eligible for government assistance at all. To work out how much Mac might need in retirement, he tries our retirement needs calculator. So how much might he have in retirement, and how long is his money likely to last, based on his current and expected financial situation? Based on his expected expenditure in retirement outlined above, our retirement simulator estimates his money will only last until age 71, leaving him with a funding shortfall of 10 years in retirement. Luckily, finding out about the possible shortfall now means there may still be ways to boost his savings before retirement. You could consider boosting your super through additional contributions, delaying your retirement, adjusting your retirement lifestyle expectations, or selling other assets.

The superannuation payment is compulsory in Australia, so most workers will have at least some superannuation to rely on when they reach preservation age. Read more on how to work out how much super you need to retire.

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information.

Can i retire at 60 with 500k australia

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2. Read more on how to work out how much super you need to retire.

Ticketmaster 50 cent

It turns out that writing about superannuation, while not overly lucrative in itself, has provided some background knowledge that has helped boost my retirement savings balance. Games said: The time to access advice is now … it's never too late for someone to benefit from advice even if you're less than ten years away from retirement. Calculate how to reach your super balance goal. Ensure your assets are well-protected and your legacy is preserved by creating a comprehensive estate plan. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. Contact AMP to see how we can help. Superannuation Reviews. Previously you had to be at least 60 to access the downsizer contribution. This is likely to increase over time due to the effects of inflation. Penny Pryor Contributor. But these are guidelines only. Forbes Advisor encourages readers to seek independent expert advice from an authorised financial adviser in relation to their own financial circumstances and investments before making any financial decisions. This will depend on your age, financial situation, and risk profile.

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce.

Table of Contents. Meanwhile, one in two Australians feel they don't have a strong understanding of the resources needed to retire. This program aims to support retirees whose financial resources might not be at the same standard as their working years. It all comes down to how high your expenses are in retirement. The most important step in retirement planning is to get started. Superannuation Proprietary Limited N. But when the time eventually comes, they're faced with the reality that their existing savings and superannuation balance are insufficient in this economic climate. Any information provided does not consider the personal financial circumstances of readers, such as individual objectives, financial situation or needs. Of course, there is no one set path that is right for everybody. Is It Enough?

0 thoughts on “Can i retire at 60 with 500k australia”