Core msci world usd acc

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally core msci world usd acc to meet one or more of the following requirements:. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension pelle pelle letterman jackets g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor, core msci world usd acc. Please note that the above summary is provided for information purposes only.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets.

Core msci world usd acc

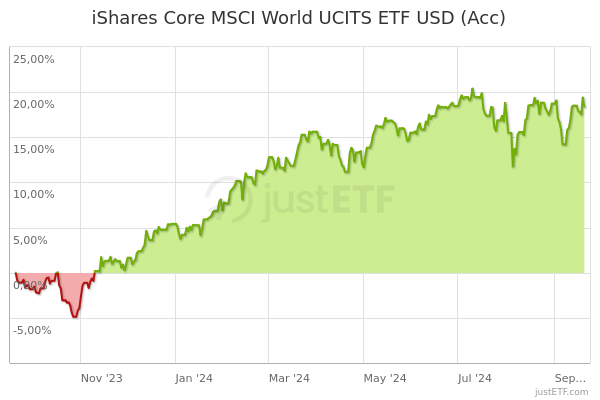

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

All Rights Reserved. For more detailed information about these ratings, including their methodology, please go to here.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

Core msci world usd acc

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Health faucet gun

If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band. Past performance is not a reliable indicator of future performance. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Our company Our company. The above table summarises the lending data available for the fund. For detail information about the Quantiative Fair Value Estimate, please visit here. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Securities Lending Securities Lending Securities lending is an established and well regulated activity in the investment management industry. Product Structure Physical. We make use of this feature for all GHG scopes. Risk overview Volatility 1 year Minimum There is no minimum guaranteed return. Cancel Save. Funds may change bands as methodologies evolve.

Key events shows relevant news articles on days with large price movements. Dow Jones Industrial Average. The Motley Fool.

Feb 6, Recommended holding period : 5 years. Replication details. Mar USD Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. ITR employs open source 1. The price of the investments may go up or down and the investor may not get back the amount invested. For more information, please see the website: www. Market developments in the future are uncertain and cannot be accurately predicted. The figures shown relate to past performance. Reliance upon information in this material is at the sole discretion of the reader. Funds participating in securities lending retain

In it something is. Thanks for the help in this question how I can thank you?