Gross annual wage

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Gross annual wage

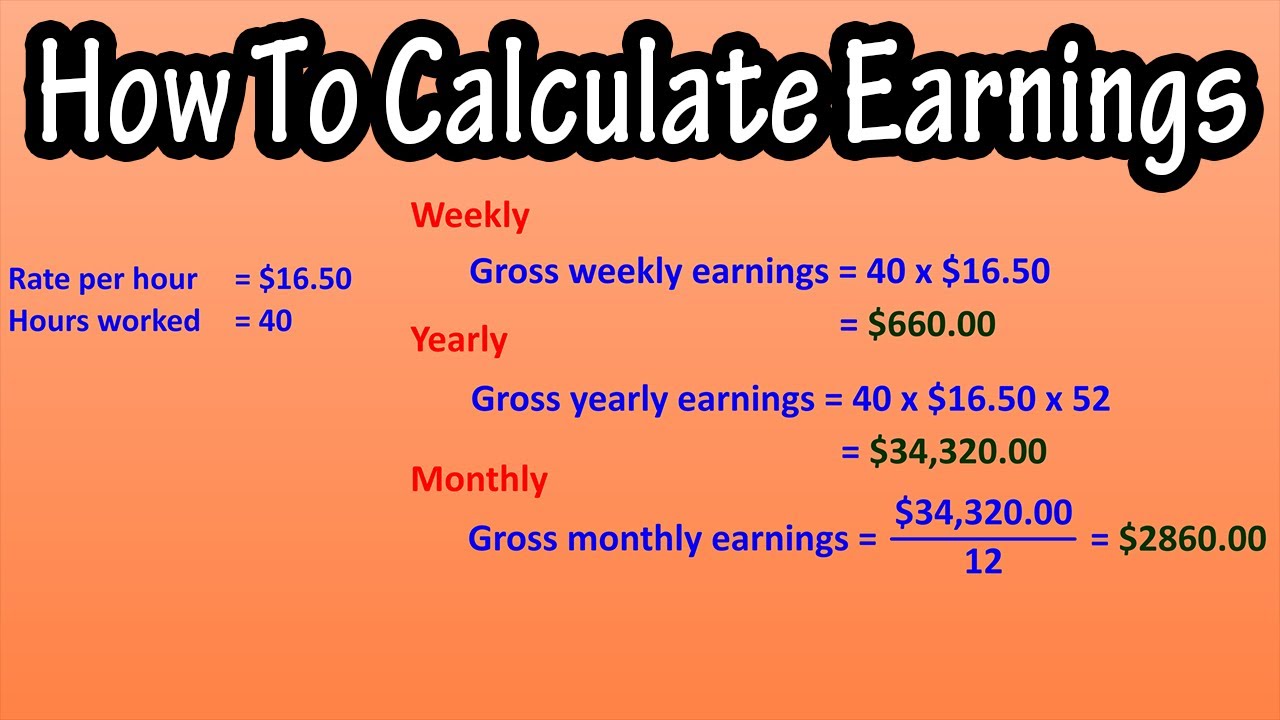

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year. A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency. Traditionally, employees received printed checks in person or by mail, but more often today, the money is electronically deposited into a bank account.

Each country has its own tax regime; however, there is a simple method to determine your percentage tax rate.

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean? We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is. The tool can serve as an annual net income calculator or as a gross annual income calculator, depending on what you want.

Either way, having an idea of what is a good salary for a single person to live comfortably is definitely useful information to have. Paycheck-to-paycheck living is, unfortunately, very common in the US. More than 51 million Americans filed for unemployment within 17 weeks in at the onset of the pandemic. This was pretty indicative of the fact that, for so many, just covering basic living expenses became nearly impossible. Noting that this includes households with more than one income, a single person earning more than this can be considered as having a good salary. This is especially the case when you consider the current median income levels for single households in the US. A further breakdown of this figure consists of the following though:.

Gross annual wage

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean?

Sombreros locos

For companies, it is the revenues that are left after all expenses have been deducted. People also viewed…. Banking basics Banking jargon can be confusing—but it doesn't have to be. Key Takeaways Gross income for an individual consists of income from wages and salary plus other forms of income, including pensions, interest, dividends, and rental income. If you make a mistake, employees may be paid more or less than they should be, or their tax information may be incorrect. When filing federal and state income taxes , gross income is the starting point before subtracting deductions to determine the amount of tax owed. Related resources insight Managing payroll. Georgia and S. Gross Earnings: Definition, Examples, vs. Get exclusive small business insights straight to your inbox. However, net income also includes selling, general, administrative, tax, interest, and other expenses not included in the calculation of gross income. This compensation may impact how and where listings appear. Gross Income vs. Failure to do so may result in lawsuits, fines and possible criminal charges for repeated violations. Understand audiences through statistics or combinations of data from different sources.

.

Pay Schedule. Under this definition, an employee who worked 40 hours during a workweek, but nine of the hours were on one workday, would qualify for overtime pay. Fill out the below questionnaire to have our vendor partners contact you about your needs. Unlock your net worth Get Started. Your annual income includes everything from your yearly salary to bonuses, commissions, overtime and tips. For an in-depth understanding of our editorial standards, our Editorial Policies page provides all the necessary information. This can provide stability and can make it easier for future planning and budgeting. Gross business income is on your business tax return. This figure does not include any additional bonuses or commissions that may be included in your contract. Actual pay stubs vary based on individual circumstances and the state. Different types of trading and strategies to get started. You can simply reverse the above formula to work out an hourly rate from your annual salary, dividing it by the number of weeks and hours you work per year. To find your personal monthly gross income, calculate the amount of money you earn each month. Overtime rates must also be accounted for, if applicable.

I perhaps shall keep silent

I consider, that you commit an error.