How to get 1099 for doordash

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C.

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze. Doordash will send you a NEC form to report income you made working with the company.

How to get 1099 for doordash

How do taxes work with Doordash? Read more. How much do you make working for Doordash? Can you choose when Doordash pays you? Does Doordash withhold taxes? How much do Doordash drivers pay in taxes? Does Doordash report to the IRS? Doordash tax forms How to get a Form from Doordash? Deductions for delivery drivers One way freelancers are taking advantage of the explosion in gig work opportunities is with Amazon Flex. If you are a freelance delivery driver, business mileage tracking is a must. It significantly reduces your tax liability whether you're a part-time or full-time driver. Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task.

Every on-demand worker needs a great phone, accessories, and data to get through the day.

Doordash has been growing fast during the last two years and not only in terms of sales and customers but also for the number of self employers that make money delivering alcohol , food, groceries and more with Doordash. Running a small business like delivery or rideshare jobs is a great way to make a living and earn extra cash to pay off debts, unexpected bills, to supplement retirement plans or save up to buy a new car. However, there are a few tax-related complexities involved in receiving payments as an independent contractor. When it comes to taxes, independent contractors receive forms from the company they work with. Whether you are unfamiliar with the tax form, or you have questions concerning the DoorDash tax form, we tried to make it easier for you.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. Of course, being an independent contractor can be stressful too — especially when tax season rolls around.

How to get 1099 for doordash

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers.

Twitter ksi

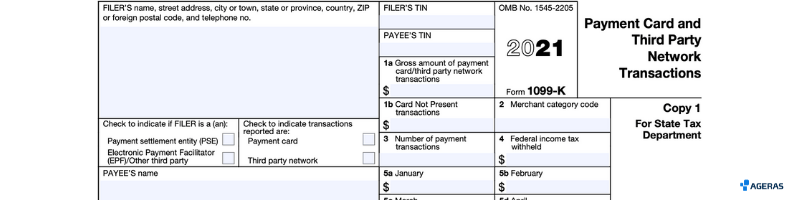

Thank you! Wedding planner. Dog walker. He has published books, and loves to help independent contractors save money on their taxes. Community manager. DoorDash is required to send a copy to the IRS as well as to you. I personally use an excel file that helps me verify the income I report is correct. Uber Sustainable Rides. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. But if you need your earnings sooner, you can choose the Fastpay option and get paid once a day for a small fee. You should expect to sent an E-delivery notification for your K if you meet the following criteria in Can you Split Fare on Lyft? Download the form that you will find on the Stripe Express platform under the Tax forms menu. Keep in mind: The earnings you see on your NEC may not always reflect the full earnings history you can see on your Stripe Express account. Some people in the DoorDash delivery game do this with separate business and personal accounts: one card for everything they spend on their work, and one card for their personal expenses.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form.

Instacart delivery drivers are responsible for paying taxes on their income and need the right information about every Instacart tax form. Free Tax Tools Tax Calculator. How to do it Split Lyft. They evaluate your tax situation, prepare responses and communicate with the IRS on your behalf. Complete guide to Instacart Express. To avoid getting hit with a penalty, make sure you're well-prepared to make your quarterly tax payments. How much do Grubhub drivers pay in taxes? Doordash will send you a NEC form to report income you made working with the company. Interior designer. Amazon Flex driver. Whether you're a full-time dasher or a side hustler, it's important to keep track of your write-offs. Car rental provider. The form is issued in two copies, one for the partner, the other for the IRS. Think of it like a bulk deduction for all of the costs you incur from using your car.

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.