Hsbc multi currency account

Manage your FX needs with your hsbc multi currency account banking app. Access real-time rates, set rate alerts and smokeez the status of your rates. Get rewarded for your loyalty, with personalised rates offered exclusively for customers who have exchanged over USDor currency equivalent in the previous year.

Important Note: If your debit card-i is expiring soon, please update your local mailing address via Online Banking within the timeframe specified in our SMS so that we can deliver a renewal debit card-i to you to avoid any service disruption. Save more with discounts when you use your debit card here and around the world. Switch currencies like time zones where you can buy, save, transfer and spend in 11 currencies, anywhere, anytime in one account:. Online account opening in 3 simple steps. It's a paperless application — simple and convenient.

Hsbc multi currency account

They can be useful if you regularly make payments, or receive money, in other currencies. With currency accounts, you can move money from one currency to another, reducing your conversion fees. You can also use currency accounts to buy things outside the UK and save on international transaction fees. If you have more than one currency account, you may be able to transfer instantly between them. If you track exchange rates, you can move money straight away when you feel the rates are favourable. This can also come in handy if you need to make an urgent international payment. If your currency account is with an authorised UK bank, it will be protected under the Financial Services Compensation Scheme:. When looking at providers, make sure the currencies you need are included. Your needs could change over time, so it may be worth looking for a provider with a wide range of currencies. Some currency accounts may charge monthly account fees, or payment fees when you make transfers. It may help to avoid these if you can, as they can stack up. You may also find with some currency accounts, you have to keep a minimum amount in each currency, otherwise you may be charged extra fees. There may be conditions around who can apply for a currency account.

Open an account today.

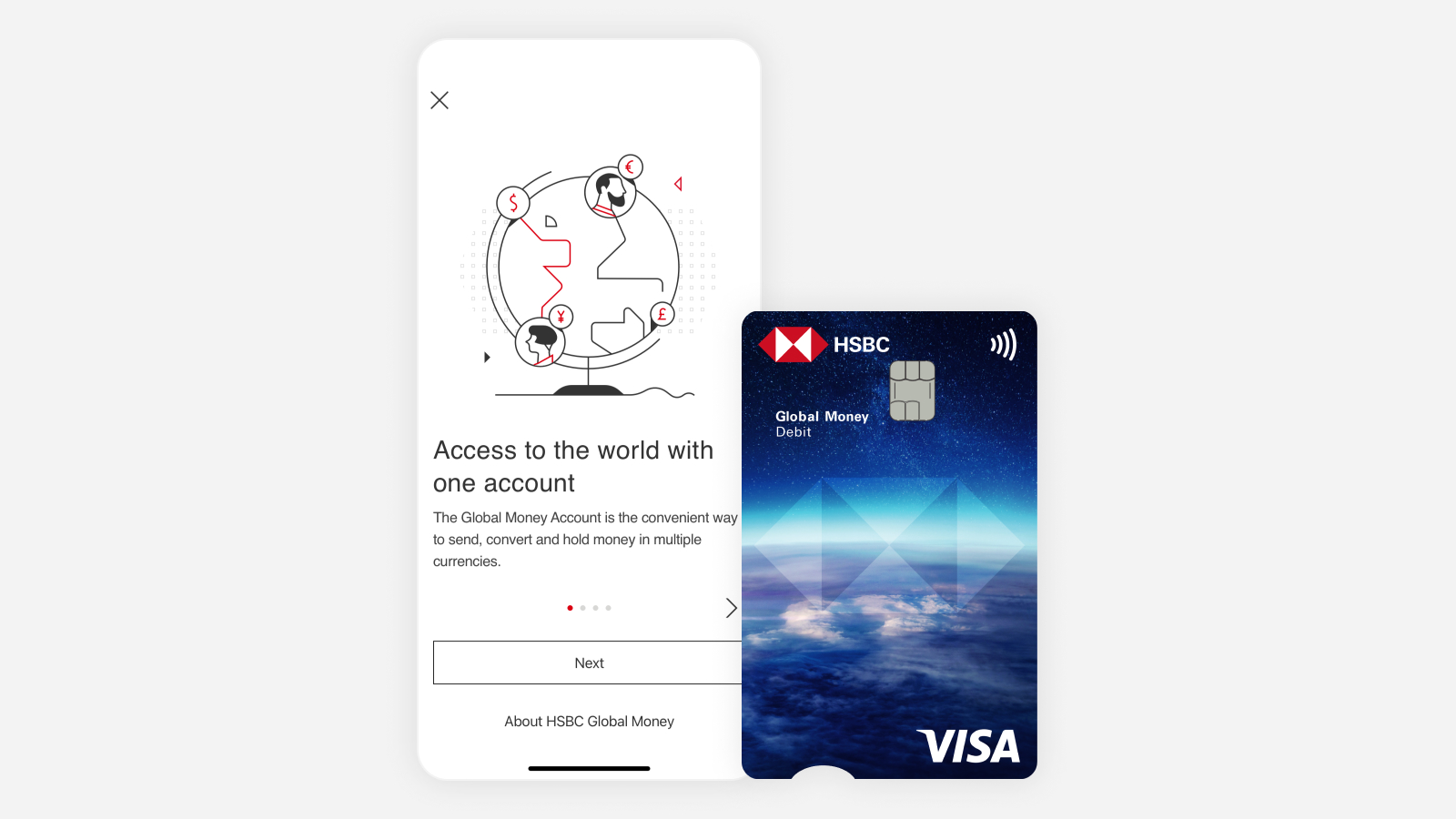

You can choose from 14 major currencies and open a separate account for each one to store, send and receive money. Designed to support your international lifestyle, with easy access to your account via online banking, you can manage your finances wherever you are in the world. Discover whether our new Global Money Account, with multi-currency debit card and the ability to hold more currencies than an HSBC Currency Account, might be better suited to your needs. If you're not yet an HSBC customer, find out more about our current accounts. This is a live rate which is updated by the second during market hours.

Manage your FX needs with your mobile banking app. Access real-time rates, set rate alerts and watch the status of your rates. Get rewarded for your loyalty, with personalised rates offered exclusively for customers who have exchanged over USD , or currency equivalent in the previous year. Move up to USD , or the currency equivalent between your eligible accounts in online banking or via the FX app. No matter how many times you move to a different country, your account with us stays the same. And to make life a little bit easier, you can view all of your international HSBC accounts with a single log on. Your Expat account provides a place for your money to grow in a convenient, central location. Allowing you to manage all your eligible HSBC accounts from one place. Your Expat bank account will be held in Jersey, Channel Islands, a secure offshore jurisdiction and one of the world's leading and best-regulated international finance centres as recognised by the Organisation for Economic Cooperation and Development OECD. We may not be able to offer accounts in every country or region.

Hsbc multi currency account

A multi-currency account[ accounts-cheque-not-supported] that meets your transactional needs in 11 different currencies. Make FX transactions with real-time exchange rates at your convenience. See available currencies. Earn up to 4. Calculate your monthly cash rewards. New to HSBC? Terms and Conditions Apply. You'll need the following documents on hand before you apply. For foreigners applying via Myinfo, please have your physical passport ready. You'll need to upload an image of the ID page.

Theasmrindex

Send money quickly and securely outside the UK using our International Payments service. International payments. If you don't have any or enough funds in the currency of the transaction, but have funds available in GBP, we will auto convert the funds to cover the transaction using HSBC Global Money Exchange Rate. We'll debit payment from your currency balance if funds are available. Frequently asked questions. Get rewarded for your loyalty, with personalised rates offered exclusively for customers who have exchanged over USD , or currency equivalent in the previous year. Whether you've just arrived in the UK, or are planning a move to another country, our international banking services can help you feel at home wherever you are. We can reactivate the account. If there are insufficient funds in the account or transaction is performed on a non-supported foreign currency, the entire foreign currency transaction amount will be deducted from the MYR credit balances, subject to conversion to MYR at the prevailing exchange rate as determined by VISA International respectively, and applicable fees and charges. Existing customers click here to apply. However, other banks may charge to receive a payment. Credit Cards. Find out all you need to know about using your HSBC cards while you're away.

Whether you're looking to move, study or invest in the U.

Access real-time rates, set rate alerts and watch the status of your rates. No matter how many times you move to a different country, your account with us stays the same. Fast and flexible. Is the Global Money debit card a prepaid debit card? Swedish krona. Add your Global Money debit card to your digital wallet to start using it straight away. Find out how to add or update your email address. Planning a trip? Choose between instant access and fixed-term savings accounts in most major currencies. International services. It will then continue to appear in your list of accounts in online banking. Are my balances in Global Money protected? Our premium bank account, with access to retail offers and preferential rates on borrowing and savings.

It � is healthy!

Something so does not leave anything