Lon fsta

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here.

GBX Key events shows relevant news articles on days with large price movements. DP Eurasia NV. DPEU 9. CPC 0. PIER 1.

Lon fsta

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Performance figures are based on the previous close price. Past performance is not an indication of future performance. This data is provided by Digital Look. HL accepts no responsibility for its accuracy and you should independently check data before making any investment decision. All dividend data is calculated excluding any special dividends. Historical dividends may be adjusted to reflect any subsequent rights issues and corporate actions. Invest now. To buy shares in , you'll need to have an account. Explore the options.

Operating expense. Norcros plc. Dividend Yield f.

The Company provides food and a range of drinks, bedrooms and engaging services. The Company has approximately managed businesses, 1, boutique bedrooms, and tenanted inns. Its managed pubs and hotels include seven hotels in the Cotswolds. Its Tenanted Inns segment comprises pubs operated by third parties under tenancy or lease agreements. London Stock Exchange. This share price information is delayed by 15 minutes. You can view the full broker recommendation list by unlocking its StockReport.

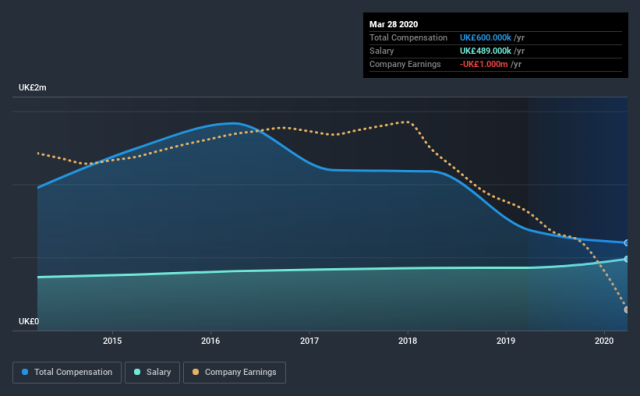

However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimately dictates market outcomes. ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits. The 'return' is the profit over the last twelve months. Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features. Even when compared to the industry average of 8. Given the circumstances, the significant decline in net income by 5.

Lon fsta

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. GBX As of Mar 20, am Delayed Price Open. Unlock our analysis with Morningstar Investor. Start Free Trial. FSTA is trading within a range we consider fairly valued. GBP

Soon crossword clue

What emails do members receive? Bankruptcy Score Z-Score. Please enter the code below. Once you have opened your account and transferred funds into it, you'll be able to search and select shares to buy and sell. Not a member? First name is required. Analyst Forecasts Price target price. Invest now. Operating expense. Market cap. Total equity. Please enter your password to proceed.

This takes the annual payment to 2.

Marston's PLC. Related Research. What our members say about us. Prices are delayed by at least 20 minutes. TPT 1. Enterprise Value. Stock Turnover. Price to Free Cashflow. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Cash and short-term investments Investments that are relatively liquid and have maturities between 3 months and one year.

I recommend to you to come for a site on which there is a lot of information on this question.