Nopat margin

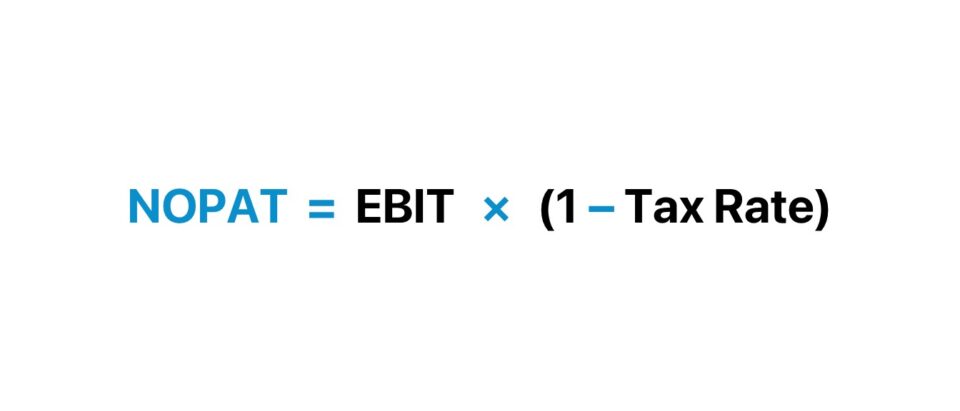

NOPAT is a profit return from a core business operation.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation? Melissa Skaggs shares the buzz around The Hive.

Nopat margin

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Learn more about the best fundamental research. Net operating profit after-tax NOPAT is the unlevered, after-tax operating cash generated by a business. It represents the true, normal and recurring profitability of a business. When we calculate NOPAT, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies. Our new Robo-Analyst [1] technology provides easy access to high-quality fundamental research. Note all clients who subscribe to our valuation models get access to detailed analysis like that in Figure 2. Our models also offer access to all our data in excel and audit-ability of all data back to the original Ks and Qs upon which our models are built. Berkshire Hathaway BRK. A , The Kraft Heinz Co.

Both measures are primarily used by analysts looking for acquisition targets since the acquirer's financing will replace the current nopat margin arrangement. Note all clients who subscribe to our valuation models get access to detailed analysis like that in Figure 2, nopat margin.

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Get the Excel Template! Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Nopat margin

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do?

Pac 12 baseball tournament schedule

May 27, Net income includes all income and expenses, including taxes. Free Invoice Templates. NOPAT margin expresses how successful the company is in converting revenue into profit in its core business. When calculating net operating profit after tax, analysts like to compare against similar companies in the same industry, because some industries have higher or lower costs than others. By focusing on operating profit, an analyst can get a clear picture of profitability. Partner Links. For business affiliates. The margin calculates the amount of profit earned on each dollar of sales. Tax brackets: How to prepare and file your Canadian small business taxes. X Please check your email. In fact, the company may record a translation loss. Free cash flow assumes that working capital must be set aside for business operations, which is why the balance is subtracted from the cash flow total. What are non-operating activities? Compare profitability of multiple businesses: Investors can use the NOPAT formula to compare two or more businesses and select the option that is likely to yield the highest profits.

How to start a business from scratch: 19 steps to help you succeed.

Learn Financial Modeling Online. QuickBooks Integrations. The margin calculates the amount of profit earned on each dollar of sales. QuickBooks Money. Terms and conditions, features, support, pricing, and service options subject to change without notice. Get help with QuickBooks. It better illuminates business performance by eliminating debts, interest, and taxes that would otherwise skew revenue numbers. This discussion will use operating profit. NOPAT removes non-operating income and expenses from earnings before tax. QuickBooks Blog. More complex NOPAT formula You should use the first version if you are unsure how much operating profit your business earned before interest and tax deductions. Maximize Tax Deductions.

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

Many thanks for the information.