Option chain

To find the small business retirement plan that works for you, contact:. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Merrill offers a broad range of brokerage, option chain, option chain advisory including financial planning and other services. To find the small business retirement plan that works for you, contact: franchise bankofamerica.

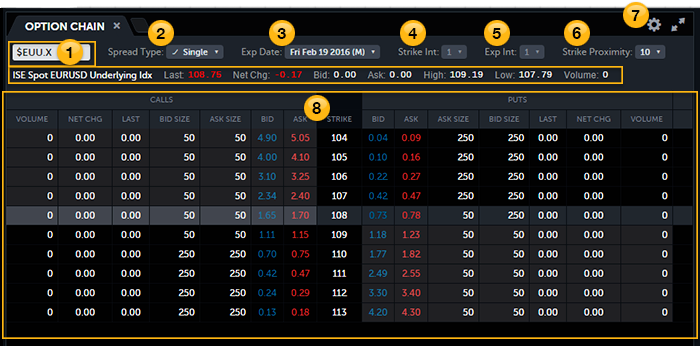

An options chain, also known as an options matrix, is a listing of all available options contracts for a given security. It shows all listed puts , calls, their expiration, strike prices, and volume and pricing information for a single underlying asset within a given maturity period. The chain will typically be categorized by expiration date and segmented by calls vs. An options chain provides detailed quote and price information and should not be confused with an options series or cycle, which instead simply denotes the available strike prices or expiration dates. Option chains are probably the most natural form of presenting information for retail investors.

Option chain

We are trying to simplify the Option Chain analysis for traders by making it easy to interpret. The option chain on niftytrader shows the position of option writers and option buyers - this will show the points of strength and weakness for the market and the position of option writers. Option Writer has obligation to honor the contract and they receive a premium for that. Premium is the price that the buyer of the option pays to the seller of the option for the rights conveyed by the option contract. A long position in a derivatives contract means outstanding purchase obligations in respect of a permitted derivatives contract at any point of time. A short position in a derivatives contract means outstanding sell obligations in respect of a permitted derivatives contract at any point of time. It is the total number of derivatives contracts of an underlying security that have not yet been offset and closed by an opposite derivatives transaction nor fulfilled by delivery of the cash or underlying security or option exercise. It is the gap between any two successive strike prices which the relevant authority may prescribe from time to time. It is the month or week in which a contract needs to be finally settled, as decided by the stock exchange. It is the day up to and on which a derivatives contract is available for trading. It is normally the last Thursday of the month.

Merrill offers a broad range of brokerage, investment advisory including financial planning and other services.

.

Volatility remains compressed as this bull market rolls on, with the VIX Index closing at A legal settlement may end up lowering broker commissions on real estate sales, hurting a key revenue stream for Zillow. Still, traders can play both sides of Z stock. HP Inc. This makes short-put plays attractive. See More. Your browser of choice has not been tested for use with Barchart.

Option chain

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Ghc epic link

In the columns following the four listed above, you will find important information to gauge market size for a given option and how traders are committed at each price level. Investopedia does not include all offers available in the marketplace. College Planning Accounts. What are the Greeks? The option chain on niftytrader shows the position of option writers and option buyers - this will show the points of strength and weakness for the market and the position of option writers. Related Terms. Use limited data to select content. It can offer very useful clues to traders especially the day traders. Product Education. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. An options chain, also known as an options matrix, is a listing of all available options contracts for a given security. How to download option chain data from NSE? How It Works As Trading Strategy and Example A bull spread is a bullish options strategy using either two puts, or two calls with the same underlying asset and expiration. What is the settlement date? Depending on the presentation of the data, bid-ask quotes, or mid-quotes, are also displayable within an option chain.

.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Market makers report the information shown in the option chain only at the end of each trading day. What are the Greeks? A short position in a derivatives contract means outstanding sell obligations in respect of a permitted derivatives contract at any point of time. Delta Effect. What are Options? Use profiles to select personalised advertising. Investment Accounts. Traders can find an option premium by following the corresponding maturity dates and strike prices. There are various excel tools available on the internet to freely download the NSE Option chain data and analyze it. Supporting documentation for any claims, comparison, recommendations, statistics, or other technical data, will be supplied upon request. Please review our updated Terms of Service. On the option chain page, you will find 2 columns - one on the extreme right and the other on the extreme left. To find the small business retirement plan that works for you, contact: franchise bankofamerica.

Certainly. All above told the truth. Let's discuss this question. Here or in PM.

Absolutely with you it agree. In it something is also to me it seems it is excellent thought. Completely with you I will agree.

It is simply matchless theme :)