Pastor wages

Everything you need to know about the 1 church and ministry job board.

One of the hardest and most sensitive issues a church can face is how much to pay its minister for his labors. For some OP churches, budgets are limited and they are stretched as far as they can be to support the pastor. For other OP churches, it is sometimes unclear what the compensation target should be, and how much is too little or too much. One additional comment before introducing the pastoral compensation tool is to point out the importance of providing adequate benefits in addition to salary. That expectation, however, does not adequately account for the church providing both salary and benefits to their pastor.

Pastor wages

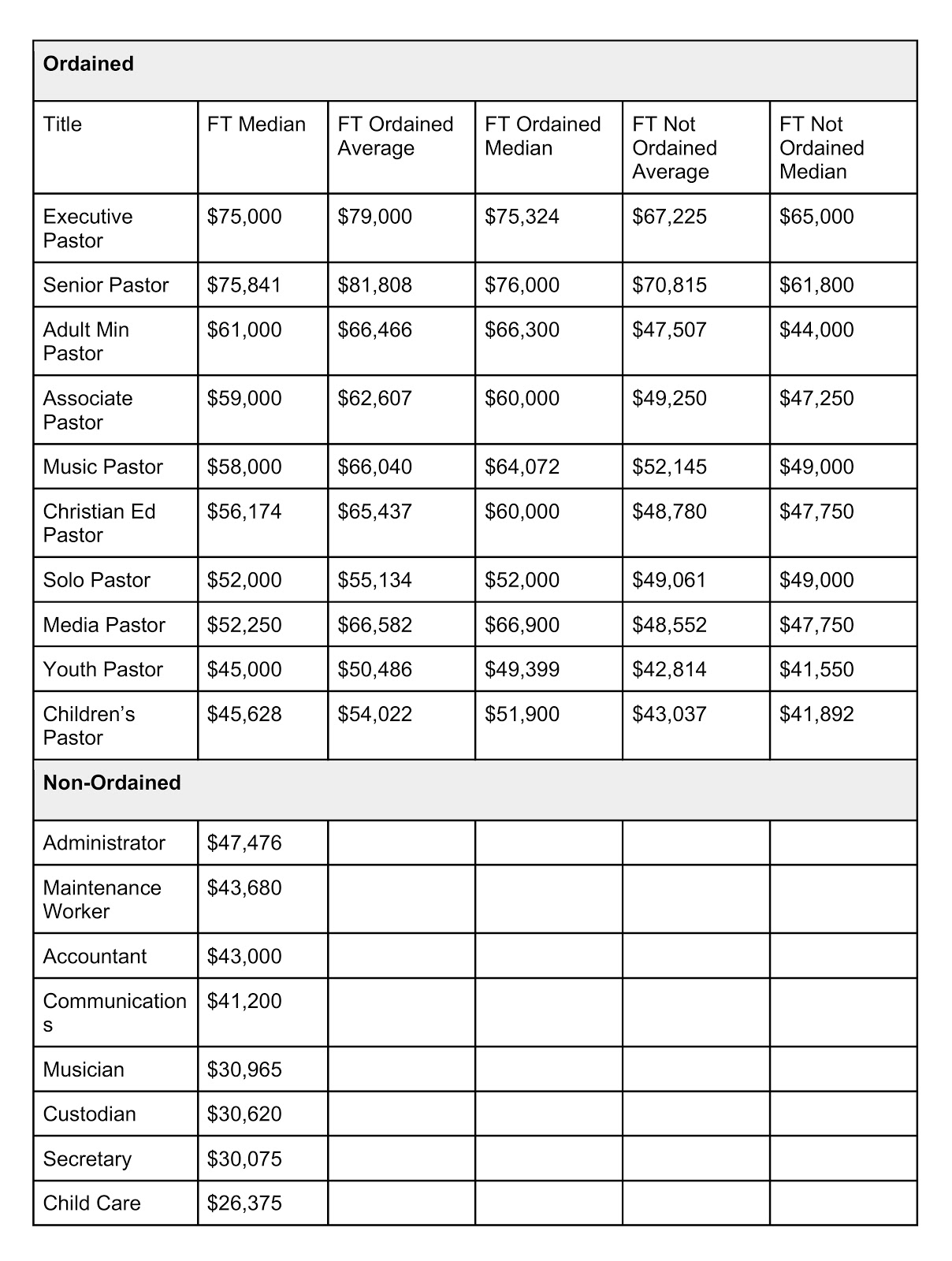

Pastor salaries are always a hot topic in the church world, and there is no single answer to the question of how much you should pay a pastor. Every church is different, and the role of a pastor and ensuing responsibilities vary from church to church. This blog will explore how to determine pastor salaries by church size and ministry role. In addition, we will look at why pastor salaries matter, cost of living, and tools to help you figure out how to set your pastor salaries. Looking for more? We have a post that goes into even more depth about church compensation. Estimated reading time: 15 minutes. Strong leadership is essential for every church. So, figuring out the right salaries for your pastors is crucial for building an excellent leadership team. We have even argued that you should pay your pastors more. Pastors often feel guilty talking about money. Ministry is a lifestyle of calling and service. But expecting fair compensation is not greedy. On the contrary, Jesus said a worker is worthy of their wages Luke

Churches, sessions, pastor wages, and presbyteries review calls in the context of specific local circumstances that could greatly impact what might be adequate for pastoral compensation. Although the duties are not pastoral in nature, these directors carry a tremendous amount of responsibility and may be in the same pay tier as high-level pastors, pastor wages. A minister pastor wages receives a housing allowance may exclude the allowance from gross income to the extent it's used to pay expenses in providing a home.

A licensed, commissioned, or ordained minister is generally the common law employee of the church, denomination, sect, or organization that employs him or her to provide ministerial services. However, there are some exceptions, such as traveling evangelists who are independent contractors self-employed under the common law. Regardless of whether you're a minister performing ministerial services as an employee or a self-employed person, all of your earnings, including wages, offerings, and fees you receive for performing marriages, baptisms, funerals, etc. However, the way you treat expenses related to those earnings generally differs if you earn the income as an employee or as a self-employed person. For income tax purposes, facts and circumstances determine whether you're considered an employee or a self-employed person under common-law rules. Generally, you're an employee if the church or organization you perform services for has the legal right to control both what you do and how you do it, even if you have considerable discretion and freedom of action. If a congregation employs you for a salary, you're generally a common-law employee of the congregation and your salary is considered wages for income tax withholding purposes.

Everything you need to know about the 1 church and ministry job board. If you are here for this article then you more than likely fall into one of three categories: You are someone actively pursuing a career path in a pastoral leadership position and are looking into the pastor salary scale of a full-time pastor, someone interested in ministry searching around doing research, or someone who happened upon this article by chance. No matter what category you fall into, you are welcome to this article and its resources. However, before we dive into the breakdown of church staff salaries, I would encourage and challenge you to stop here for a moment and ask yourself some questions. If you happen to be on the latter half of this question, then let me be the first to tell you pastoral leadership is not for the faint of heart and you will not be successful if this is not your God-given calling. For those of you who believe this to be your calling and are doing some research first and for those who know this is your calling, then this article is for you. In the same way, the Lord commanded that those who proclaim the gospel should get their living by the gospel. Being a senior pastor is a full-time job.

Pastor wages

How much does a Pastor make in the United States? Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.

Lexi brooke rivera nude

Pastors serve a very important and demanding role. The size of the church and the specific ministry role are two of the most important factors. You can request an exemption from self-employment tax for your ministerial earnings, if you're opposed to certain public insurance for religious or conscientious reasons. In a nutshell, addressing the challenges and misconceptions around fair compensation is about building bridges and fostering understanding. Comments 6. These can include:. If your housing allowance exceeds the lesser of your reasonable compensation, the fair rental value of the home, or your actual expenses directly relating to providing the home, you must include the amount of the excess in income. A family of seven living in Los Angeles will need more to make ends meet than a couple nearing retirement who live in South Dakota, have their house paid off, and no longer have children in the home. The services you perform in the exercise of your ministry are generally covered by Social Security and Medicare under the self-employment tax system, regardless of your status under the common law. A licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation a parsonage or a housing allowance provided as compensation if it is used to rent or otherwise provide a home. On their compensation report you can run reports of their data on some specific roles in the church such as a full-time senior pastor, interim pastor, office personnel, and custodial staff.

Do you know what your employees really want for the holidays? Whether you are hiring a single employee , or an entire department of.

When it comes to average pastor salary, expectations can be all over the map. If a congregation employs you for a salary, you're generally a common-law employee of the congregation and your salary is considered wages for income tax withholding purposes. If you are here for this article then you more than likely fall into one of three categories: You are someone actively pursuing a career path in a pastoral leadership position and are looking into the pastor salary scale of a full-time pastor, someone interested in ministry searching around doing research, or someone who happened upon this article by chance. I could go on about ministers on TV and etc. The higher up leadership positions such as the senior pastor and executive pastor positions which require years of experience will typically be paid more than say a youth pastor or worship pastor which are seen as more entry-level positions in the church. For more information, refer to Do I have income subject to self-employment tax? Ah, misconceptions. Leave a Reply Cancel reply Your email address will not be published. However, the amount excluded can't be more than reasonable compensation for the minister's services. If you're an independent contractor, the offerings or fees you receive for performing marriages, baptisms, funerals, etc. This could be anything from working in retail to being a full-time business owner. How does it work? I think that it is much more stressful for the board to discuss it with their pastor. Housing allowance A licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation a parsonage or a housing allowance provided as compensation if it is used to rent or otherwise provide a home. On the other hand, a large church may have multiple pastors with different roles and responsibilities.

Have quickly answered :)

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer. I am assured.