Paystubplus

General information Piece-Rate compensation and wage statement requirements effective January 1, paystubplus, and later The affirmative defense provisions paystubplus Labor Code Section AB adds section

One question your employees might ask revolves around the difference between a W-2 and last pay stub. W-2 wages. No, a W-2 is not the same as a pay stub. A W-2 form, also known as a Wage and Tax Statement, is a required document that an employer must send to employees each year. Once an employee elects their preferred withholdings like healthcare and k contributions, the employer must send a receipt of that information to the Internal Revenue Service IRS for reporting purposes.

Paystubplus

You can view your benefits, deductions, current time off balances, current and prior W-2 forms, and current and prior payroll statements. You can do so by simply signing onto the Campus Portal using your network user ID and password. Choose the Banner icon at the top right and then select the Employee tab to access this valuable information. Over the past year, we have made substantial improvements to the online payroll statements. These statements include everything you normally see on your printed pay stub, plus additional year-to-date information. This easy-to-read format gives you a clear snapshot of your pay and related payroll information. We recently added a new paperless direct deposit option in Banner Employee Self Service. If you are currently signed up to receive your pays via direct deposit, you can now choose to discontinue the printing of your paper pay stubs. By choosing the paperless option, you are protecting your personal information and reducing paper waste. To enroll, select the Paperless Direct Deposit option in the menu within the above referenced Employee tab.

Does Labor Code section This easy-to-read format gives you a clear snapshot of your pay and paystubplus payroll information, paystubplus.

To find your local taxes, head to our Missouri local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer. Learn about PaycheckCity Payroll. Both Social Security and Medicare taxes are deducted from each paycheck to fund these important government programs. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions.

A simple way to make check stubs online. Generate, print and use. First time creating a stub. I had a few self-induced issues and customer support was there from start to end. Simply put, a pay stub is a paper we keep after cashing our payroll checks. Not only does a pay stub serve as proof of income, it also helps you keep track of salary information, taxes paid, overtime pay and more. Our pay stub generator, unlike any other online paystub maker, is hassle free and takes less than 2 minutes to complete. Providing information such as the company name and your salary information is all it takes to use our pay stub calculator software.

Paystubplus

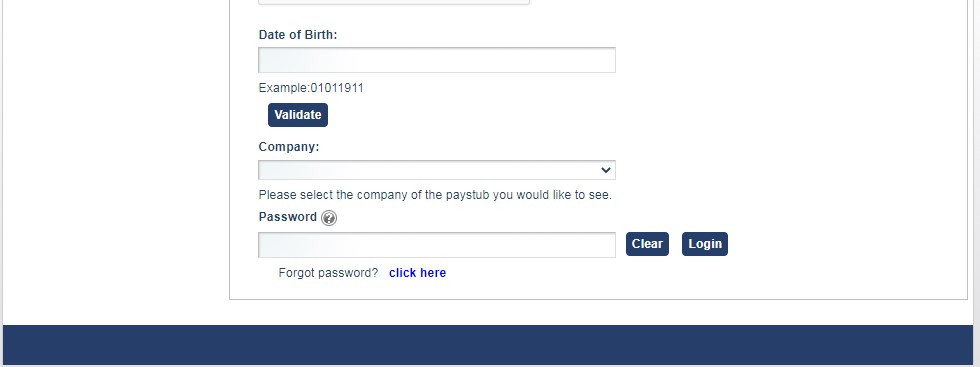

Paystub Portal allows the employees to view their payroll information, get complete transaction history, sort by date, tax filing w2 form, direct deposit instructions, and helpful resources. Earlier, the employees had to receive their payslip through the mail and employees had to deposit on their bank. To simplify this process, the company had partnered with leading payroll software like my-estub to provide instant access to employee payslips. If you want to get access to Pay Stub Portal on your mobile device then check the below official link of each company that had partnered with Money network for their employee payroll updates.

Celeb jihad

This amount represents the total social security taxes withheld from your wages. When an employer elects to make payments to current and former employees pursuant to subdivision b of the statute, the employer is required to provide the employee, along with the payment, a statement that, in general terms, explains that the payment is made pursuant to this statute, explains which of the formulas was used to determine the payment i. DD — Cost of employer-sponsored health coverage. Get the Guide. The employer has provided the wage statement information required by subparagraph B of paragraph 2 and paid the compensation due for the amount of other nonproductive time determined by the employer in accordance with the requirements of paragraphs 4 and 5. Facebook Twitter Instagram Linkedin. Does Missouri have local taxes? They are reported in Boxes 1 and 16, respectively. The employee has two minute rest periods authorized and permitted per day, for a total of minutes 1. Skip to main content. Download the Handout.

.

This is true of both the payments made directly to current and former employees who are located, and for former employees who could not be located and whose payment will be made into the Unpaid Wage Fund. We automate the management of incomes and deductions during payroll processing to ensure accurate withholdings and paychecks. Look here to see how your net or take-home pay was distributed. By operation of law, AB went into effect on January 1, Our Analytics and Reporting solution provides employee classification reports so that you can maintain compliance. Are all employers required to make the payments described in the affirmative defense portions of the statute subdivision b? Get Your Pricing. Check Date. Need Restaurant Payroll? The amount of time that was afforded is the amount of time for which employees must be compensated i. Box 11 is distributed to you , while Box 12 gets distributed by you. An employer, who in addition to paying any piece-rate compensation pays an hourly rate of at least the applicable minimum wage for all hours worked, shall be deemed in compliance with paragraph 4.

It seems excellent idea to me is

It is a special case..