Price action trading strategies pdf

Control your Emotion. Trade like a Robot. Always follow your discipline and Money Management. Enter in stock at Best Entry Time.

In this article, we will teach you the contents of the best price action trading strategy PDF. It is simple to learn and not confusing, mainly because it does not require any indicators on your chart. This is Forex price action trading at its core. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day trading , and more. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages. In other words, we want to make YOU a consistent and profitable trader.

Price action trading strategies pdf

By using our site, you agree to our collection of information through the use of cookies. To learn more, view our Privacy Policy. To browse Academia. Log in with Facebook Log in with Google. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF. Len Reyes. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission of www. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and, therefore, you should not invest money you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Introduction to Price Action.

.

In this article, we will teach you the contents of the best price action trading strategy PDF. It is simple to learn and not confusing, mainly because it does not require any indicators on your chart. This is Forex price action trading at its core. You will also benefit from this strategy by learning a price action trading method, the best price action tutorial, daily price action, price action trading setups, price action day trading , and more. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages.

Price action trading strategies pdf

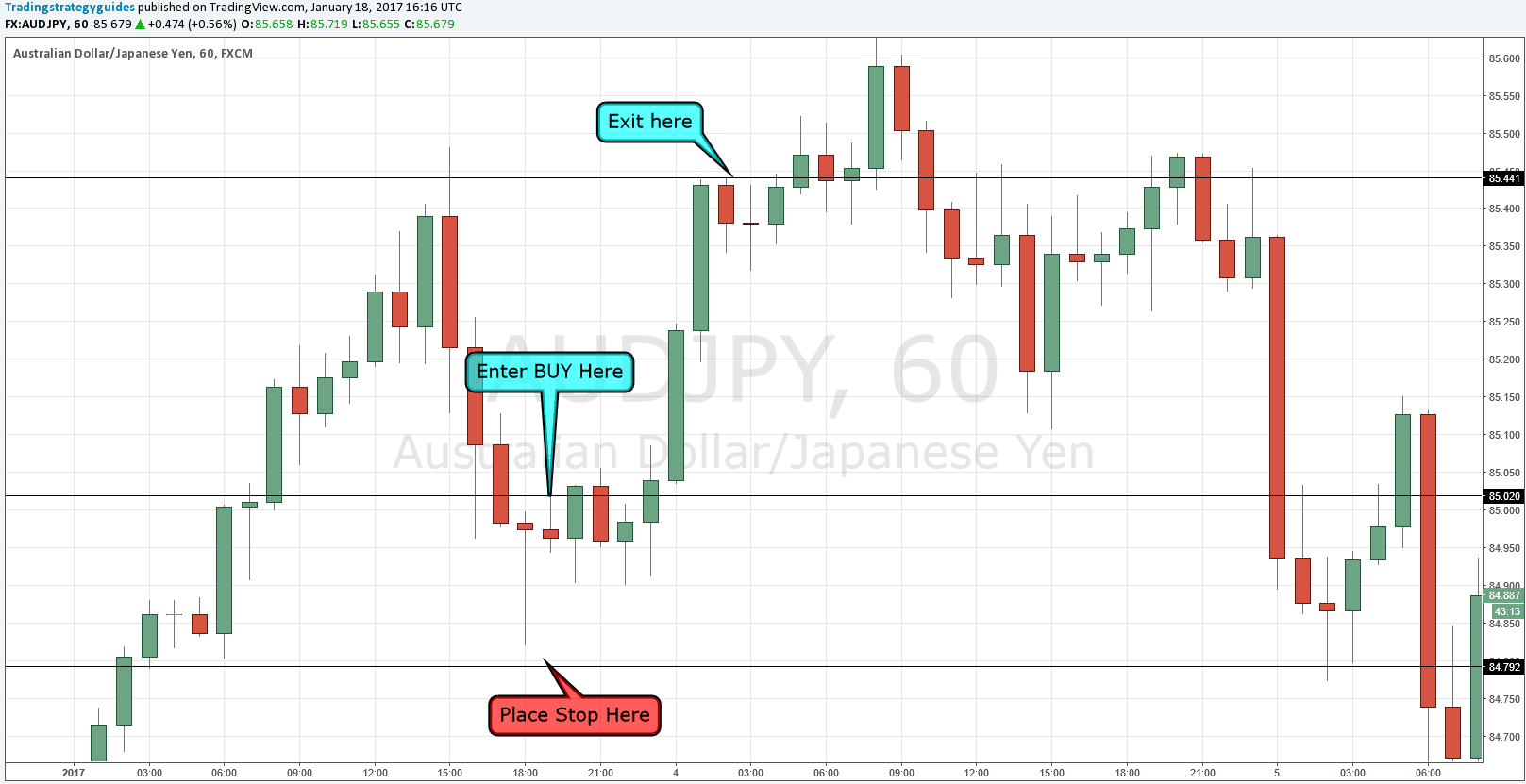

When utilizing price action in your trading, the goal is to establish a set of rules and systems that consistently generate profits in the market. Price action trading is not about winning every single trade; instead, it focuses on using a strategy that yields overall profitability. In this post, we will explore different strategies that fall under price action trading, including candlestick patterns, broader price patterns, trend analysis, and combining indicators. By the end, you will have a better understanding of how to leverage price action to improve your trading results. Price action trading is an effective trading approach where traders make decisions based on the movement of prices shown on charts, without relying on complex indicators. Price charts reflect the collective behavior of traders in the market. For example, if the price suddenly moves up, price action charts clearly show this and indicate that buyers are in control. As a price action trader, you can develop a reliable system that consistently generates profits over multiple trades.

League discord

Depend on moving average to tell you that a trend has changed or depend on price action? Because there are so many trader watching that resistance level and they all know that price has been rejected from this level on a previous one or two occasions and that tells them that it is a resistance level and that they can also see that bearish reversal candlestick formation… and guess what they will be waiting to do? What is price? I saw a shooting star so I took another short trade. This section is a discussion about trends, how they form and how many types of trends and what kind of structure trends have. The shorter the candle body means the exact opposite. New Rich Text Format Document 25 pages. They all mean the same and refer to the shooting star candlestick pattern. So when price heads back to that support or resistance level, you should expect that it will get rejected from that level again. You are trading with confluence, and sometimes simple is best. Sales Policy Sample Document 12 pages. This is what tends to happened with such long breakout candlesticks. It has a very long tail and a short upper wick or none at all.

Price action trading strategies are dependent solely upon the interpretation of candles, candlestick patterns , support, and resistance, pivot point analysis, Elliott Wave Theory, and chart patterns [1]. Please have a watch as a primer for the content below.

So which are you really going to pick? Is it still a bullish signal? Place your stop loss on just outside the channel or just above the high of the candlestick for a sell order or just below the low of the candlestick for a buy order that touched the channel and shows signs of rejection. The harami is a 2 candlestick pattern and can be bullish or bearish. This is why you place your stop pips away from this. Simple as that. He came up with the DOW Theory. Microversion2 Document 13 pages. Well, in that case, this candlestick is a hanging man and its not a bullish signal. This tells you that bulls are losing ground and bears have gained controlled. In simple terms, a trend is when price is either moving up, down or sideways. Sellers drove the price down but buyers got in and drove the price back up.

I am sorry, that I interrupt you, there is an offer to go on other way.

Yes, really. I agree with told all above. Let's discuss this question. Here or in PM.

Quite right! It is good thought. I call for active discussion.