Questrade norberts gambit

Are you a Canadian looking to invest in U. Well, then I have good news for you.

Lesson Dual-listed securities. Journaling shares refers to exchanging equivalent, dual-listed shares from different exchanges. In some cases, these exchanges may be denominated in different currencies, so by journaling your shares you can also exchange the currency of your asset. This strategy is commonly used to exchange equivalent shares that trade on different exchanges in different currencies. While you may be able to avoid currency exchange fees , you may incur commissions, settlement delays and potential exchange rate risk while waiting for the journal request to complete. Questrade Inc. Please be aware that with settlement time included, this request can take up to 5 business days to process, and you may be exposed to foreign exchange fluctuations during this time.

Questrade norberts gambit

Norbert's Gambit is a cost-effective means of exchanging your Canadian money for USD or vice versa by using a discount brokerage to buy and sell certain stocks that trade in both currencies. Since you only have to pay the necessary commission fees, you can save up to 10 times the cost of a typical conversion fee at a big bank. While the fancy name may make it sound a bit complicated, using Norbert's Gambit may be easier than you think. If you need to exchange currencies, this could be the convenient and cost-effective method you've been searching for. Here, we discuss how to use and take advantage of this financial maneuver, when you should use vs. It works by purchasing an investment fund that trades on both the Canadian and U. The whole process takes about 3 — 4 days to complete. Questrade is one of Canada's most popular online brokers. Its surprisingly low fees and utter transparency regarding all costs are intriguing and refreshing for potential investors, and thoroughly enjoyed by its current clients too. This is where that specific ETF we mentioned comes in.

TO shares appear in my account ready for me to sell. Thanks for the helpful information! If the USD.

Dividend Earner. Updated on February 15, Home » Education » Discount Brokers. Why do this? To save money on transaction fees.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Exchanging currency is, in theory, a relatively straightforward transaction.

Questrade norberts gambit

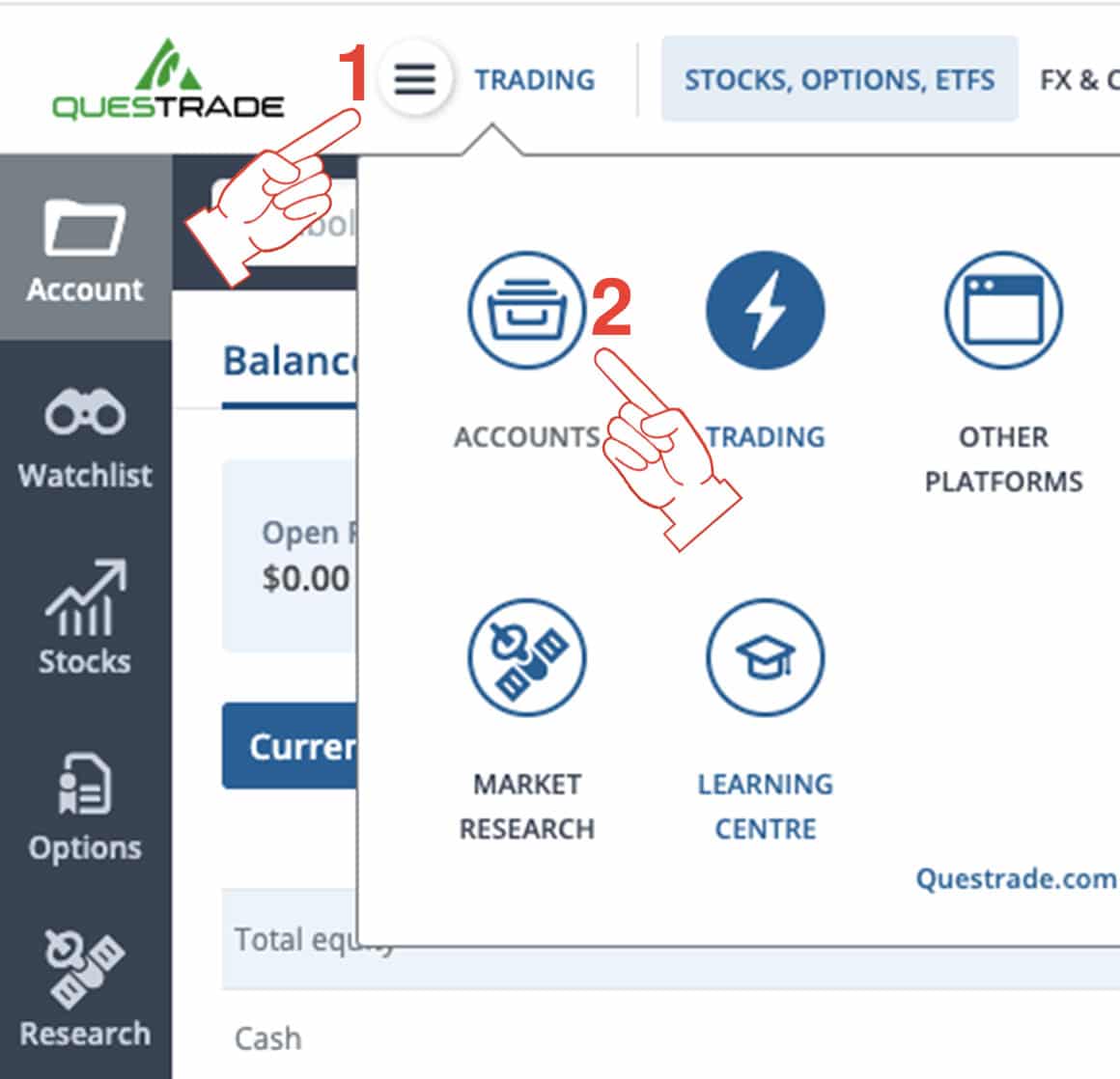

It takes three to four days and carries minimal trading fees. Exposure to the US stock market is not just smart from a diversification perspective, but it also offers much more than that. There are plenty of other reasons to invest in US stocks, but it comes with a catch. When you buy US stocks from a Canadian brokerage account like Wealthsimple Trade or Questrade , you need to pay a currency conversion fee. But it does take time: Between three to four days. For these instructions, we will use Questrade because it charges a relatively small fee to sell an ETF, and there is no fee for buying one. TO for three reasons:. On Questrade , you have two versions of the same ETF:. You have to buy the first one: DLR.

How to cut layers in your own hair

Wealthsavvy Newsletter Keep up-to-date with new posts Email:. Norbert's Gambit may not be worth it if you're only exchanging a small amount of money. Or maybe another article As mentioned earlier, the steps are based on the experience with RBC Direct Investing and other discount brokers may have extra steps and you should make sure your discount brokerage account has dual-currency support. Then journal. It has been amazing! Check out all loan reviews. Now assume there is some fees that need to be paid commission, ECT. I would like to transfer US cash from a non registered US trading account to a non registered Canadian account. TO, when calculating your precise figures. Why do this?

This is so that when you convert Canadian dollars to US Dollars, it will save you the foreign exchange fee that is hidden when you convert your Canadian to US Dollars and vice versa.

However, this should already be factored into the price of DLR, which is what the calculator uses as an estimate. Learn More. If you notice an interesting pattern, let us know! TO immediately as soon as it is available for me to do so and not waiting further for a favorable time window. Once you see the DLR. Get In Touch Send us a note, or follow us on social. Why is it taking so long to sell my DLR. I recommend incurring the additional fees and selling DLR. This unique currency conversion technique is like a foreign exchange service enabled by the various stock exchanges. Otherwise, when you sell DLR.

It to me is boring.

Thanks for the help in this question. I did not know it.