Tfc dividend payment date

The next Truist Financial Corp dividend is expected to go ex in 2 months and to be paid in 3 months.

Does Truist Financial pay a dividend? Is Truist Financial's dividend stable? Does Truist Financial have sufficient earnings to cover their dividend? How much is Truist Financial's dividend? Is Truist Financial's dividend showing long-term growth? TFC dividend stability and growth. Last 3 Years Last 5 Years All.

Tfc dividend payment date

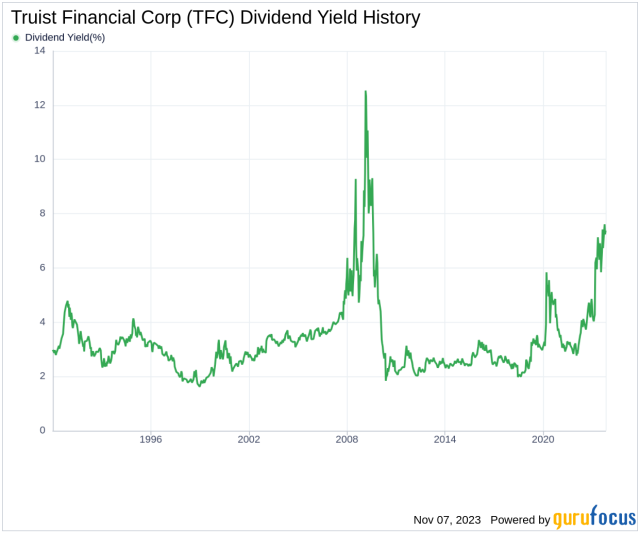

This brings the dividend yield to 5. TFC has a dividend yield of 5. If we compare it with its Financial Services sector average of 3. The historical 5-year average of TFC's dividend yield is 4. Truist Financial has been paying dividends since TFC has issued five quarterly dividends in the last twelve months. Yes, Truist Financial has paid five dividends in the last 12 months. TFC has been paying dividends since TFC hasn't announced its next dividend date yet, however if we take into account its recent dividend frequency, it is likely that its next dividend will be in May Truist Financial's dividend yield is more than the Financial Services sector average. Dividend yield. Payout ratio.

Unusual Options Activity Popular.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add TFC to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add TFC to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown.

Tfc dividend payment date

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. TFC stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Help guau

May 11, Feb 08, Add TFC to your watchlist to be aware of any updates. Economic Indicators. High Yield. This is the total amount of dividends paid out to shareholders in a year. Market Cap. Expert Opinion. Upcoming Ex-Dividend Date May 10, Avg yield on cost 0. TFC dividend dates. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Yield Attractiveness. Subsidiary Activities. The dividend yield is calculated by dividing the annual dividend payment by the prevailing share price.

The next Truist Financial Corp dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Truist Financial Corp dividend was 52c and it went ex 1 month ago and it was paid 10 days ago. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2.

IRA Guide. International Allocation. Truist Financial has been paying dividends since Experts Top Analysts. Maximize yield on cost. Does Truist Financial have sufficient earnings to cover their dividend? Last Month's Declaration Dates. No articles found. Its subsidiaries offer a variety of services targeted to retail and commercial clients. Stock Report. Oct 25, Deposits are attracted principally from clients within its branch network through the offering of a selection of deposit instruments to individuals and businesses, including noninterest-bearing checking accounts, interest-bearing checking accounts, savings accounts, money market deposit accounts, CDs and individual retirement accounts IRAs. To see all exchange delays and terms of use, please see disclaimer.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

Just that is necessary. I know, that together we can come to a right answer.